TEAL COMPLIANCE

COMPLIANCE THAT WORKS

Compliance that works and keeps your law firm, your colleagues, and your clients safe.

What makes Teal Compliance different?

Compliance challenges that law firms face are usually caused by significant, deep-rooted issues. If these underlying causes aren’t addressed and fixed, your compliance is never going to work.

That’s why we’re different to other compliance firms. We don’t just fix the issue you can see, we find the underlying cause and make sure it’s dealt with. Once the underlying cause has been resolved, we can start our journey together to help build compliance that really works.

Combined we have over 100 years of experience in legal compliance, and recognise that one of the most common underlying causes is a firms culture. We’re passionate about embedding a compliance culture within law firms, that provides everyone with confidence that they, their firm, and their clients are safe.

What are Teal Compliance's areas of specialism?

Teal has a vast amount of expertise in numerous areas of compliance, such as:

AML

Compliance

The legal sector is particularly vulnerable to money laundering and we’re here to help fully equip law firms with compliance and training.

Regulatory

Compliance

As regulations now focus on outcomes, law firms often need guidance on how to translate the requirements into practical measures. That’s where we can help.

Data

Protection

Data protection is vitally important, especially for law firms, given the personal and often sensitive client data they have in their possession. We can help.

Risk

Management

Whether it’s legal and regulatory adherence, reputation management, protection of assets, cyber-security, or strategic decision-making, we’re here to help.

What services does Teal Compliance offer?

We offer a range of services for law firms to build ‘compliance that works’!

SORTED Programmes

Our comprehensive SORTED Programmes will enable you to spot the gaps in your compliance and fix them quickly.

Compliance Training

We make our compliance training courses as practical, engaging, and enjoyable as possible.

Ask Teal: Consultation Services

Whether you want the answer to a compliance question or need a second opinion, our Ask Teal service can help.

Legal Compliance Audit

Our legal compliance audit will ensure you get answers to the questions you’ve been struggling with.

Policy Review & Writing

Our policy review and writing service will ensure the policies and procedures you have in place work.

Website Audit

Our website audit will ensure that your website is compliant with the most up-to-date regulations.

Teal Tracker

Teal Tracker is our technology solution for your compliance needs, record keeping and analysis. It will save you time and resource and help highlight trends and issues that need addressing.

What method does Teal Compliance use?

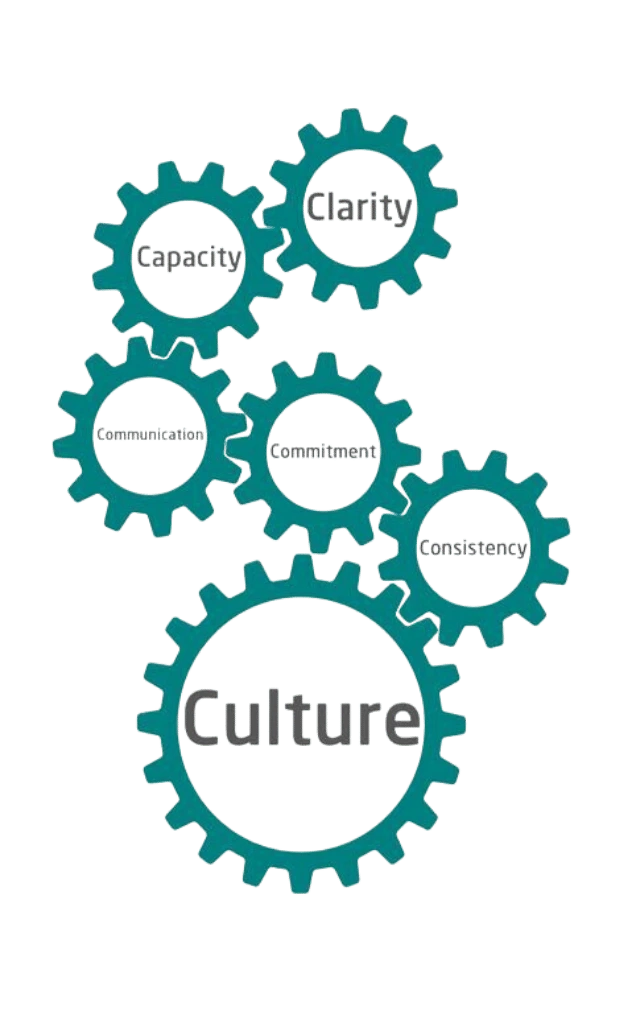

All our services are based on our ‘6 Cs of Compliance’, which is our 6-step method that guides you to make a practical compliance framework that works. Our 6 Cs of Compliance are:

- Clarity

- Capacity

- Communication

- Commitment

- Consistency

- Culture

If you’d like to know more about our services and how our 6 Cs of Compliance method works, get in touch today.

Why choose Teal Compliance?

At Teal, we believe in:

Being honest with our clients

We’ll never recommend a solution that doesn’t fit with a firm’s risk profile.

Giving our clients practical help

We’ll implement our solutions quickly and apply our guidance immediately.

Sharing what we have

We’ll share our knowledge and experience, when our clients need it.

We know how hard lawyers work to serve their clients, but they can often be vulnerable to considerable risks, as well as severe consequences.

We care passionately about protecting law firms and keeping them safe. With over 100 years of combined experience, you can rest assured that if you choose Teal Compliance, you’re in safe hands.

Simply contact us today to discuss your needs and one of our experts will be in touch without delay.

Choose compliance with confidence. Choose Teal Compliance.

Get

In Touch

If you’d like to find out more about how Teal Compliance can help you, we’d love to hear from you.

Send us your enquiry and we’ll be in touch.

Feel Safe, Call Teal 0333 987 4320